How do i Rating A great MSHDA Loan?

You are able. They MSHDA are offering. From inside the 2018, MSHDA rolled aside an application where they provided buyers $fifteen,one hundred thousand when you look at the down payment direction and every season it had this new household 20 percent of your own DPA could be forgiven.

It had been called the Step of progress Down payment Direction System. However,, all those loans went in early 2019.

It’s no extended open to home buyers. Alternatively, the fresh $seven,five-hundred DPA and you will 10K DPA will be programs open to home buyers as well as Have to be paid.

Insufficient Guarantee Which have MSHDA Fund

The following disadvantage to a MSHDA loan is actually probably the shortage from equity on the first few years. A lack of collateral helps it be difficult to sell the brand new domestic later on. Otherwise, you may find on your own in a poor guarantee position in the event the house beliefs drop.

A poor guarantee standing might be described as are underwater on your home loan. It is when you owe additional money than simply you reside already well worth.

That create a challenge if you would like sell your property. A full mortgage count needs to be paid down, nevertheless when you will be underwater, you don’t have adequate money.

To repay the mortgage and you may purchase closing costs, you have got to render more money towards the closure otherwise chance going right on through foreclosures or an initial-selling.

Within the last long time, MSHDA consumers have not was required to worry about bad guarantee just like the family viewpoints grew a great deal. Within the 2021 alone, eg, home values enhanced by 18 percent.

not, prior growth is not an indication out of future development. Definition, simply because home values have cultivated, does not always mean they’re going to continue to grow.

Remember that a low equity condition will likely be problematic in the event the home values miss while never plan to remain in a property for a long time.

Obviously, it is difficult to virtually any financing option. Besides MSHDA. Home buyers with FHA finance or USDA funds can be at just as much chance.

That is the perception for taking out. MSHDA works for a purchaser whom intends to stay in the house to have a great very long time. I would recommend no less than several to five years given most recent prices manner in the 2022, however, possibly additional time depending on the means home values circulate.

In spite of the term MSHDA loan, you can’t actually make this loan yourself because of MSHDA. Alternatively, you should contact one of MSHDA’s credit couples.

They also create a list of their better loan providers inside particular areas. You can manage a lender anywhere in the condition of Michigan. Such, you could be when you look at the Muskegon and you will work on an excellent MSHDA financial into the Wayne State (close Detroit).

The union which have certainly Michigan’s most useful MSHDA lenders enables us to greatly help home buyers score connected and you may entitled to MSHDA funds.

We send customers so you’re able to Gordie MacDougall. You could arranged a zero obligations 15-moment phone call with him if you find yourself curious about way more from the MSHDA or if you qualify.

Ought i Score A MSHDA Loan Which have Less than perfect credit?

Really, one to hinges on everything define while the poor credit. We could possibly features various other viewpoints about what less than perfect credit try.

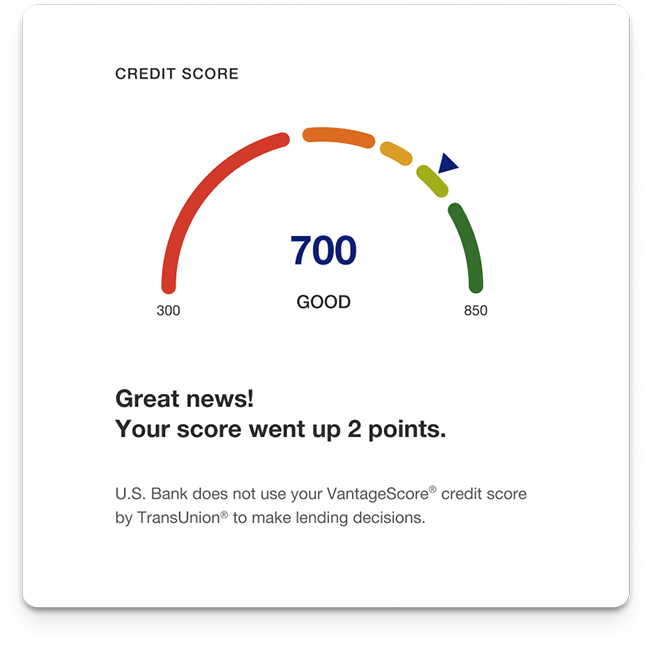

So you can be eligible for the fresh new MSHDA mortgage, you should have good 640 credit history. Are you experiencing at least an effective 640 credit rating?

I encourage your work with improving your credit rating. Which could mean paying off personal debt, swinging personal debt into other formats, setting up credit cards, and.

Their exact situation should determine the latest tips just take. When you’re a new comer to payday loan Prattville your credit rating, take care to perform a little research or contact a cards fix business.